That Tax Report & The Problem With Labour Designing a Capital Gains Tax: Look at their past efforts.

The coming factory farming of humans in New Zealand’s Tax Surveillance State.

I’ve allowed days from David Parker issuing the report on taxation paid by 311 of New Zealand’s richest families before publishing this: I left off writing because I was too angry, as usual, at what New Zealand has become, and I wouldn’t have had control of my language at the brazen lying which is the leitmotif of this government and their pamphleteers, New Zealand media.

My point in this piece is to write that even if you agree with a capital gains tax (CGT), and I don’t, then based on their history, the kindergarten of this government would still be the last bunch of toy hoarding infants you’d want to design same. But a note, first, regarding infamy on the announcing and reporting of this ‘study’ inappropriately researched and published by Inland Revenue: inappropriately because this is wholly a political document from Labour to pave the way for the CGT they will be electioneering on, even if not ever stated clearly, and IRD should not have become politicised like this including the unethical trawling through the lives of these families on what is an illegal - or should have been - fishing expedition for the department without cause and breaching the four year statute bar: these 311 families are entitled to their privacy as human beings just like you and me. Everything about this report was an abuse of power by David Parker, government and New Zealand’s most powerful department. (See interview in footnote 1).

Infamy:

Quoting myself, because no one else is going to:

Liberty, freedom and privacy are three foundational words to being human that have been executed from the political lexicon: they were frog marched and stood before a wall of Pfizer-fogged minds, blindfolded, then shot, with the whimpering staccato of ‘equality’ and ‘fairness’ and ‘don’t kill granny’, resounding over and over. And not only did this atrocity go unreported by journalists in the mainstream media, they were in the firing squad.

This in mind, look at how duplicitously New Zealand’s most renowned wannabe communist dictator, sorry, economic commentator, Bernard Hickey, has described the results of the report:

Hell isn’t hot enough for useful idiots like this. Bernard blocked me on all social media 20 years ago when I was blogging the first time and I nick named him Kim Jung Hickey as his solution to every government intervention causing harm in free markets and our economy was always more government intervention into free markets and our economy. I have learned since not to call people names, although no regrets in this case as thank god I don’t have to put up with reading nonsense and dishonesty on this self-serving scale.

Bernard’s byline is a brazen lie on the level of Grant Robertson’s doublespeak that his landlord interest deduction limitation (elimination) rule was to close a loophole of landlords claiming interest, which it wasn’t because every business group and investor gets to claim interest on funds borrowed with a nexus to their income earning activities.

The 9.5% tax Hickey speaks of is on the 311 families’ economic income; he leaves that word, economic, out. Economic income includes their realised and (majority) unrealised capital gains on investments and on their businesses (which pay taxes that aren’t counted in this study because the study is setup to scapegoat these families for a malevolent government). The PAYE earners he speaks of who are taxed at 30% - and that’s ignoring our progressive tax scale - on their taxable income have houses, and holiday houses and boats, and shares, too, but he conveniently leaves the untaxed capital gains they will have pocketed and unrealised gains they will have on those out, and refers only to taxable income in their case, not economic income, because Bernard is determined to ruin the country with a capital gains tax, he’s obsessed with it, and like all authoritarians Truth is a luxury of the class war he has disposed of along with journalistic ethics; although to be fair, the whole fourth estate in New Zealand has done the same because, of course, Labour’s pamphleteers, the student activists at the Herald, buttoned down on the lie:

To wit, my reply:

For clarity:

These high income families as well as providing the industry and farming base of our economy, hundreds of thousands of jobs, unlike the unproductive toxic bilge Bernard pens, in reality pay the bulk of the tax take that runs our society: roughly the top 3% of income earners pay 27% of the tax take and the top 20% of taxpayers pay near 70% of the tax take. But Bernard overlooks that. So the wealthy families of this study pay far more than their share of the tax on their taxable incomes than PAYE earners do on their taxable incomes.

And here’s the final point on Bernard’s, Parker’s and Herald’s deception. They assume a tax should be paid on economic income, on realised capital gains – as is imposed in many countries, fine – but also unrealised capital gains on assets which is the bulk of their ‘economic income’. Guess how many countries in the world tax unrealised capital gains on any asset or include it in a definition of taxable income?

The answer is just one, and that country is New Zealand, and I’ve written on it within the last two weeks, being taxing the unrealised holding gains on overseas shares caught in the Foreign Investment Fund regime. [Also foreign currency gains on non-exempt financial arrangements, but that’s another post.] Noting further that in the countries that tax realised capital gains, with taxes that do so ‘fairly’, they logically allow inflation indexing, but no mention is made of the effects of inflation in any of this reportage: Michael Reddell makes the point well:

The 311 families had the privacy they were entitled to stripped from them by sham law passed under urgency from this totalitarian government, and in a sick joke from power were forced to pay millions to their lawyers and accountants to put together the voluminous data demanded back to 2016, breaching the four year statute bar because this is not a (quotation mark) audit (end quotation mark), to become victims of the bureaucrats from IRD’s high wealth hit squad – it’s an actual unit - trawling through their private family lives on a fishing expedition doubling as Labour electioneering: your financial data in the detail they are looking, is the book of your private life. Listen to the interview in footnote 1, even their children were interrogated by IRD inquisitors on threat of jail for their mum and dads. Minors. Imagine the bleating from the politicians who legislated this abomination were the press given this access to their families on pain of imprisonment. Because for all this, as Reddell points out, under the law as it stands these families were not found wanting on their tax obligations: I put it to you they are upstanding citizens that contribute through their business and philanthropic endeavours more than all of New Zealand Twitter put together, and every minister in this toxic government, and were meeting their obligations, yet this government vilifies them anyway, deliberately, as they childishly vilify landlords and punish them with discriminatory punitive taxing, and for election purposes are prepared to throw these 311 families to the baying mob of envy they want to create thanks to a complicit, corrupt legacy media, just as Chris Hipkin’s with his miscreant mate Shaneel Lal and New Zealand Herald incited the mob to violence against #LetWomenSpeakAuckland:

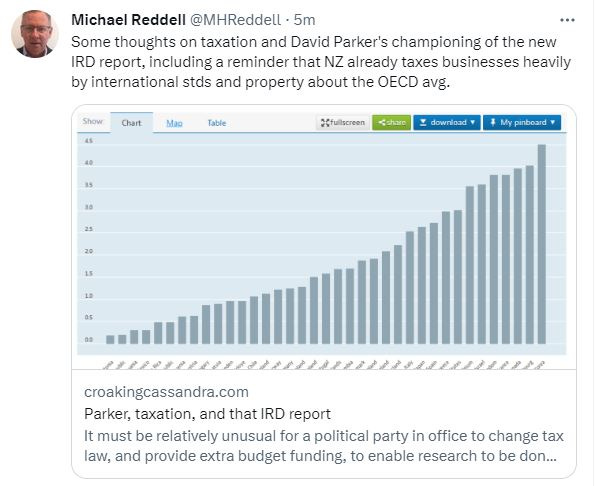

Finally this also from Michael:

And by the by, from that piece regarding the inappropriate politicisation of IRD which in a functioning democracy with a fourth estate should have been reported as scandalous:

“It must be relatively unusual for a political party in office to change tax law, and provide extra budget funding, to enable research to be done towards that party’s next campaign manifesto. But such it appears to be with the High-wealth Individuals research project, the report on which was released yesterday, loudly championed by the Minister of Revenue, David Parker. Not many government department research papers – and that, we are told, is all it is – get a Foreword from a senior Cabinet minister.”

There’s a word for this: corruption.

One other point: for you and me Joe and Joanne Average with our assets in trust we pay a trustee tax rate of 33%, as these 311 families do, but Maori Trusts, on billions of dollars’ worth of property and assets, pay the equivalent of only 17.5%, and when the CGT is imposed we know it won’t be on Maori assets, don’t we. Why do we have this dichotomy Mr Parker? Maori who can afford to aren’t paying their way under any definition of income, economic or otherwise. Co-(Maori)-governance is appallingly one sided in our New Zimbabwe.

That’s enough of infamy. It is obvious Labour is using this study to foreshadow electioneering on a capital gains tax for this coming election, and that’s whether they’re transparent about the fact or otherwise (the dog whistle here is easily enough signal to their voting base): historically they have been the least transparent government, as totalitarian governments are; they have forced Maori governance on the country already by the Maori veto which exists in every council and government department, and Three Waters is only about Māori governance, instituting an historic constitutional coup d’état that was never electioneered on, and they had no mandate for such is their authoritarian arrogance and disregard for rights, freedom and the processes of the rule of law in what was formerly our democracy but is no more. So just because Parker says no new taxes are forthcoming from this report before the election, in reality that doesn’t mean squat, and he has achieved everything he wanted out of this black ops persecution of the 311.

Because there’s a CGT coming.

And given their history in tax policy drafting, even the supporters of a CGT better be very careful what they wish for with Labour designing it, because look at their awful record.

Labour’s History with CGTs & General Taxing of Un-Made Income:

Just in the brief time I’ve been writing this second blog, I have already published the following relevant pieces on Labour’s woeful tax policy making:

I have shown how due to the fall in equity markets over the 2023 financial year, likely to continue through this year and then with possibly years to come of low returns to make up for excessive equity valuations that built up under loose as a goose central bank monetary stimulunacy, some investors caught in our hotch potch Foreign Investor Fund Regime implemented by a Michael Cullen in a previous Labour government will end up being taxed more than if we simply had a straight out capital gains tax on overseas shares such as in Australia, UK or USA with the ability to use losses or carry them forward.

I have shown that under Grant Robertson’s discriminatory denial of interest deductions to landlords that many mum and pop property investors who were trapped in now financially lethal investments by unethical retrospective legislating will suffer the fate of my sister, namely, her taxation bill from a domestic rental would have risen over 400% and she would – if she had kept the rental property – have had to pay her entire profit each year to IRD plus find half again from her pension, because she would have been taxed, like all such investors with gearing, on more than her real profit. Taxed on un-made income. (The consequence on her having to sell that property was her single mum tenant is out of a house and thus I surmised this tax disaster is behind why families in emergency housing in New Zealand has doubled).

And then there’s the last time a Labour government wrote the policy for a CGT on property to be implemented if Helen Clark had won another term. Have we all forgotten that? What a disaster that was going to be. It was to apply to property outside the primary residence, fine, however, an owner’s deduction against sale was going to be set at only the valuation on a set valuation date, not on the higher of that valuation or cost. For ourselves we had a holiday home bought for $800,000 but our valuation date valuation was only $720,000 - because we always like to buy our holiday homes over the years on the peak of a market (or at least it ends up that way). So even had we sold the house for the $800,000 we paid, and made no money, we would have been taxed on $80,000 un-made gain anyway! I wrote before the election to Michael Cullen stating the bill had to be changed to ‘the deduction is the higher of value on valuation date – inception of law – or actual cost’ but I heard nothing back. Furthermore, that CGT had no provision for inflation indexing so per Michael Reddell’s post above we would have been paying tax effectively on the inflationary lift in value that gave us no economic value at all. Thank god Labour lost that election.

Given all the above do you want this Labour government writing up a CGT?

I sure as hell don’t.

And don’t kid yourself the capital gains tax they design will be just catching the 311 high wealth families. As it always does, the tax burden will fall on we in the tax whipped middle class. Farmers forget emissions taxes, that will be the least of your problems: David Parker hates you, he never tries to hide it, and has a CGT strait jacket ready to be fitted, effectively an inheritance tax, the final nail in the coffin of the family firm, and advent of New Zealand as a corporate factory farm: a denuded countryside other than dead forests of toxic pinus radiata farming carbon credits in one of the biggest scams in human history, and few workers left on the land as we are all herded into 15 minute cities to be hatched and batched in mass unsunlit housing estates eating our muesli of insects and farmed by tax collectors with all the ruthless surveillance apparatus of the State. Which, as I like to get my two years storm ruined Moetapu Bay Road into my posts, is also why NZTA and the Marlborough District Council aren’t bothering to fix it, happy to leave the lives of all affected Marlboroughians in inhuman limbo while we are forced to prostrate ourselves before bureaucrats and their consultants hoping for alms; that is, our tax monies used for our own actual benefit.

Long past time for a revolution against tyranny in New Zimbabwe.

Footnote 1:

This IRD research paper was persecution. Take your envy goggles off and put yourself in the shoes of these parents, their children interrogated by IRD’s High Wealth hit squad under pain of their parents being jailed otherwise, whose sole crime was being successful and running businesses and farms for the betterment of all of us. The only editorialising on the day of this report in the legacy media should have been how scandalous the breach of privacy was and that all the costs of this illegal fishing expedition by IRD for Labour electioneering should be paid back to these families by the taxpayer to compensate them for such an egregious abuse of state power. Both David Parker and the Commissioner of IRD should resign, as should every MSM editor.

I don’t know how to insert this video interview so below is the link direct to it on The Platform, or just clink here:

https://theplatform.kiwi/podcasts/episode/rich-lister-troy-bowker-on-the-ird-s-intrusion-on-wealthy-kiwis-with-sean-plunket

Other posts in this series:

NZ’s Foreign Investment Fund (FIF) Regime: A Mess That Needs Fixing for Savers’ Sake.

Grant Robertson’s Landlord Interest Deduction Limitation & NZ’s Emergency Housing Crisis.

Will Hipkins be Announcing a Tax Free Income Threshold Next Week?

![Life Behind the IRon Drape II - Post-Covid Edition [ Mark Hubbard ]](https://substackcdn.com/image/fetch/$s_!0kpA!,w_80,h_80,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fbucketeer-e05bbc84-baa3-437e-9518-adb32be77984.s3.amazonaws.com%2Fpublic%2Fimages%2Fa952431d-e2f4-4138-8c2c-65f85e66f379_406x506.jpeg)