Grant Robertson’s Landlord Interest Deduction Limitation & NZ’s Emergency Housing Crisis.

This Tax & Social Disaster Defines All That's Wrong With Labour / Greens. [Worked Example Included.]

The number of households that have lived in emergency housing for more than two years doubled, that’s doubled, last year as more and more families fell into low income poverty and beneficiary dependence, but also, unrecognised, because of Grant Robertson’s reckless and unprincipled approach to taxing, specifically the discriminatory landlord interest deduction limitation which breaches ethical policy making and weaponises our tax system against a class of taxpayers this government and their unsophisticated voting base love to hate. For a government that announced proudly its attack on child poverty, there can be few own goals worse than the unintended consequences of this legislation.

I said in my post on all things wrong with our Foreign Investment Fund regime which will see many victims of the FIF regime paying more tax on their overseas shares in the coming years than under a straight out capital gains tax, that important features of a tax system are fairness and certainty: that taxpayers and business people can be sure of operating within a rational and principled framework that applies to all, and that abusive governments won’t persecute any particular set of industries or professions unfairly in a cynical call to their voting base. On that account the landlords interest deduction limitation is an affront on all fronts.

Given how mum and pop landlord investors have provided the cheapest tenancies to all tenants but particularly lower socioeconomic tenants, including providing better quality housing than Housing NZ, I have never understood the wrong-headed antipathy toward them by the tribes of the Left. Case in point and a man who I would expect to know better, enter Labour party troll, Clint Smith:

Clint is that parasite class of consultants, a booming industry of greed feasting off the entrails of we taxpayers that has mushroomed under this government to obscene numbers and expense, consuming and destroying the country’s wealth – capturing for themselves taxes taken that should be fixing my two year broken roads in Marlborough Sounds where we are stuck in endless and pointless consultancy - while using their connections to government to ply their corrupt trade running spin for incompetence. And by spin here I mean lies. And by lies I mean in the case of the interest deduction limitation, to punch down on mom and pop investors, AND THEIR TENANTS, who don’t have his pull in high places.

Look at this drivel:

And Clint is not alone in this blind hatred the unproductive have towards landlords in New Zealand. [Name of account holder erased so no pile on – Clint’s left above because he’s beltway and has been advising this government.]

I asked the multi-degree qualified - he authoritatively assured the thread - owner of this account what these tax breaks were that landlords received, but of course he did not answer because as I’ll show there are none. Which leads to the next question being assuming these two are not being mischievous then how are they so wrong on this? I think, chiefly, they’re blinded by resentment and hate, as the Left tribes are on all whom they like to cancel under the catch-all greedy epithet, albeit in reality just business people and workers who make up our economy: they’re down an economic rabbit hole of misinformation grokking around in a self-reinforcing echo chamber in Wellington trying to make sense of a world in which that shrine of a free lunch with no responsibilities offered by their leaders and their bankrupt ideology, keeps slipping out of their grasp and into the social dystopia they have created. Because this ignorance on landlords comes from the top.

When introducing this blunt and brutal tax law on a surprised New Zealand - landlords had no idea this was coming - Grant Robertson lost all respect from the legal and accounting professions when he made up the lie he was correcting a loophole whereby landlords could claim mortgage interest against rental income.

What?

There was no loophole here, Mr. Robertson’s bare faced lie on this might have convinced his befuddled following of anti-intellectual wastrels, but to capture all of the considerable issues involved let’s look at this from the viewpoint of the enemy of his second hander ideology: reality.

Meet my so-called greedy sister. She and her late husband have worked hard all of their lives, from farm work, to running corner dairies, to latterly over the last 15 years that occupation where you must remain open all hours with no social life, a motel leasehold in a small provincial rural town. Husband died two years ago, having just reached 65, sister has had to carry on running the motels by herself, including through the horror that Covid was for motelliers, until she could sell the leasehold and retire, which she has just done. For her retirement this greedy capitalist has: the subsistence state pension, a 1970’s little two bedroom home in said small town, plus a small term deposit that will allow for few luxuries in retirement, the house bought out of a bit of money saved over a lifetime, the small amount received from the sale of the motel leasehold and the sale of a rental property. Note because they sold their home originally to purchase the motel leasehold, they subsequently bought the rental property in lieu of a house to move to when there were retired, or if the motels did not work out, and just to keep themselves in the property market. Because my sister is widowed she has bought the more suitable retirement house, but would have liked to retain the rental for an income, and to not displace the tenant, a single mum who’d been a good tenant for a long time. But the ruthless mathematics of Robertson’s interest deduction limitation made this impossible: here’s the figures for the last year before the phase-in:

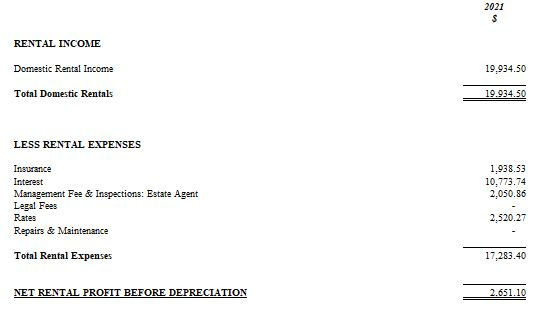

The math.

Profit in 2021 of $2,651 taxed at her marginal rate that year of 30% (owing to shareholder salary from motel) equals tax payable of $795, so free cashflow - ignoring accruals - of the profit, $2,651, less the tax payable of $795 equals $1,856 which went on paying the mortgage off. Nothing flash but buying her way into a little equity (albeit having to use drawings from the motels to pay the balance of mortgage principal each year).

But rework the figures for when Robertson’s black arts are applied. Interest is not deductible, so that added back gives taxable profit - that doesn’t exist - of $13,425. Tax payable – literally an immoral theft now – is $4,027. Free cashflow is destroyed: there is still only TRUE profit of $2,651, so my sister has to use all that to pay the year’s tax, plus then find a further $1,376 of the tax from other income as well as the loan principle; but she will be retired, there is only enough to live, so she was standing on the precipice of a huge cash hole, the property becoming both impossible plus pointless to hold. Just in case this hasn’t won home with you, on the same real net profit that’s a 407% increase in taxation cost from $795 to an investment destroying $4,027; over four times the amount of tax payable and nothing about the cashflow from the rental has changed except the whole profit and more besides now goes to government leaving the investor ruined. Understand that: she would have to pay her entire year’s profit to government, plus find more from her pension to pay the balance of the usurious, unethical tax each year. You won’t be surprised to learn that the month after the 2021 balance date, the year in which the three year phase-in started, she sold the property to a school teacher and his family that had moved into the district.

A fair tax system?

If you have a geared rental, slot your figures in as above by adding the interest back to your last year’s net profit, see the damage in additional tax payable at your gearing level and work out if you can, or why you would, stomach this. Many will find sadly that it is costing them dearly and more than they can afford to provide quality affordable accommodation to New Zealand’s working poor and beneficiary sector. Many have made that calculation ahead already.

Because where did my sister’s single mum tenant go? I have no idea, however, returning to where I started, it can’t be a coincidence that the number of households that have lived in emergency housing for more than two years doubled last year, which was the start of the phase-in for the landlord interest deduction limitation.

And for the joke of transparency that this government once touted to us all, does Grant Robertson or Clint want to tell my sister what the tax breaks she was receiving were? Landlords were receiving no tax breaks. Claiming interest was not a loophole.

Everybody in business, farming or investment without exception can claim interest deductions against income on funding taken to fund their income earning activities: so long as there is a nexus to the income earning operation. You must be able to claim interest, as with all the other expenses incurred to run a business, against your income so you are only paying tax on your net income, no business or investment can be viable on any other basis; look at the example above. If you bring down a loan to buy shares then you can claim the interest against your dividend income (and profits if a trader). There was no loophole here, Robertson was straight out lying and he knew it: his promotion of this law was an exercise in cynicism and dishonesty which appears to be the hallmark of his government. He was playing to this idiot fan base who loves to hate landlords they childishly classify as greedy. Playground taunts by playground bullies who are a bit thick when it comes to comprehending the world around them.

Because the above is before you look at the further reality which these economic conspiracy theorists aren’t able to admit in their fantasy world of ideological ignorance, that on latest tax figures 68.5% of government tax revenue is paid by just the top 21.2% of tax payers. It’s these so called greedy ‘rich pricks’ harking back to a former Labour Party Finance Minister, Michael Cullen, creator of the abysmal FIF regime, who pay the bills for our society. And not only do they get no thanks, they get vilified in a manner that is slander in my opinion, by the slouching creatures featuring in this post. It couldn’t be clearer than the TV1 News summary of a report released last week called Effective Tax Rates Imposed on the Incomes of New Zealand Residents:

And I’m not finished with the larceny this law is.

Do you think my sister is greedy retiring in her modest little house in provincial New Zealand? Your average landlord is my sister: not rich by any stretch, simply more comfortable with a property investment than equities or financial styled investments owing to the particular psyche of Kiwis (for reasons that are another whole post, but hinted at in my FIF post) and risk averse banks happy to lend over property before riskier business or financial investments, and noting these private landlords were providing – proudly providing to boot - affordable housing to low income New Zealanders, better than government does. The government housing provider to this group doesn’t even have to comply with the healthy homes legislation that private landlords do. And the cost of emergency housing to the taxpayer for this displaced class of tenant is millions every day as their lives are ruined, with no track back to a proper home in a market of dwindling affordable rental stock.

Worse again, in respect of what Robertson has done, I’ve called his landlord interest deduction limitation blunt and brutal above for good reason. Another hallmark of a bad tax system other than being unfair and creating uncertainty is legislating punitive taxing mechanisms that work retrospectively so people are caught with unconscionable penalties with no ability to save themselves: they are just bankrupted. Good tax policy makers don’t do it. But Robertson is not a good policy maker so he did. This limitation rule should have been fenced off to landlord investors buying properties after its application date, buyer beware, but instead it is applied retrospectively after only a short phase-in period, to all existing landlords who find themselves now trapped in investments they have paid the considerable transactional costs to enter, legal, etc, and are costly to quit, especially in the property downturn now upon them, while the basis on which they entered the investment is wholly destroyed and taken from under them by the whim of a vindictive government whose attitude to these ‘greedy’ landlords is mistaken, shallow, and cynical.

This is a disaster of a law.

Shame on this Labour / Green government. Shame on Grant Robertson. And I can’t decide for myself what is worse: how unethical this tax legislation is, how callous, or how incompetent given it’s dreadful unintended consequences for the very people a Labour government was supposed to protect. This lower socioeconomic group forced into emergency housing, that’s motels, at huge expense to the taxpayer, so that upper middle class mum and dad could help finance sons and daughters into their first homes.

Any new government must rescind this abomination of a law on the first sitting of Parliament.

Addendum: Before publishing the above, I noticed the below on Twitter: how perfectly apt to everything I’ve just written:

![Life Behind the IRon Drape II - Post-Covid Edition [ Mark Hubbard ]](https://substackcdn.com/image/fetch/$s_!0kpA!,w_80,h_80,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fbucketeer-e05bbc84-baa3-437e-9518-adb32be77984.s3.amazonaws.com%2Fpublic%2Fimages%2Fa952431d-e2f4-4138-8c2c-65f85e66f379_406x506.jpeg)